Brighten Loans Scam (August 2020) Some Unknown Facts! >> The article is about the information regarding a company that provides personal loans.

Sometimes, it becomes hard to fulfill all the requirements over salary, which is why most people sell their personal things to get some cash. But most of the time, people have to compromise with their needs; there are ways to get rid of it by taking loans. We will cover the information about Brighten Loans Scam in this post.

There are several types of loans offered by banks in the United States like a car loan, home loan and personal loan, in which only a personal loan allows you to spend that money according to your needs. Sometimes, it becomes necessary to fulfill the demand, which can be done by cash only; it may be the medical emergency, maybe house repair, car, or personal use.

Table of Contents

About Brighten Loans

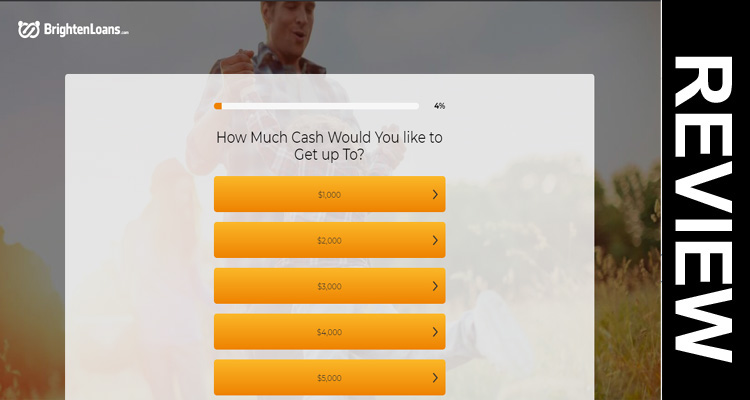

Brighten Loans were founded in 2011; it provides loans from $100 to $5000, for that you have to submit all the necessary documents for documentations as per the norms of the United States. The company then will send all your documents copy to an approved lender and after getting verified and approval from your side on terms and conditions, the cash will directly forward to your account.

People may be confused about whether it is Brighten Loans Scam or safe, and so far, we don’t find any negative remarks on the website. However, one common issue raised in the related article is the inadequate customer care response. Few of them also pointed out the lack of information provided about the lenders.

Features of Brighten Loans

- It is best for those who want fast cash.

- Easy to apply, simple process.

- Requires flexible Credit score.

- Secure funding of secured and unsecured loans.

- Payment terms are from 12-30 months.

- Wide range of lenders.

- Approval of loan within 24 hours and maximum within 48 hours.

Policy

People might be unsure about the company and having thought of Brighten Loans Scam, or it’s genuine. But the company policy says that all the information collected from the applicants will be kept encrypted. Policy violations will not be accepted in any case; the reason for providing secured or unsecured loans to the borrower will be kept safe.

All the information and data regarding the applicants will be stored in the data server.

Interest Rates

No credit score is required for applying for a loan, the interest rates of the loan will be 5.99% to 35.99% annually based on the loan and term period, which is twelve to thirty months.

Conclusion

The information which we found on the internet, accordingly we can say that there are no adverse remarks available. Although we were not able to find out, the borrowers review whether Brighten Loans Scam or not. The interest rates and the services are easy, but the customer assistance needs to be improved as per the concern found over a few web pages.

If you have any experience with Brighten Loans or ever applied for the personal loan, you can share your experience with us in the comment section below.